Credit Product Setup

General setup of credit product parameters in the Mbanq credit module

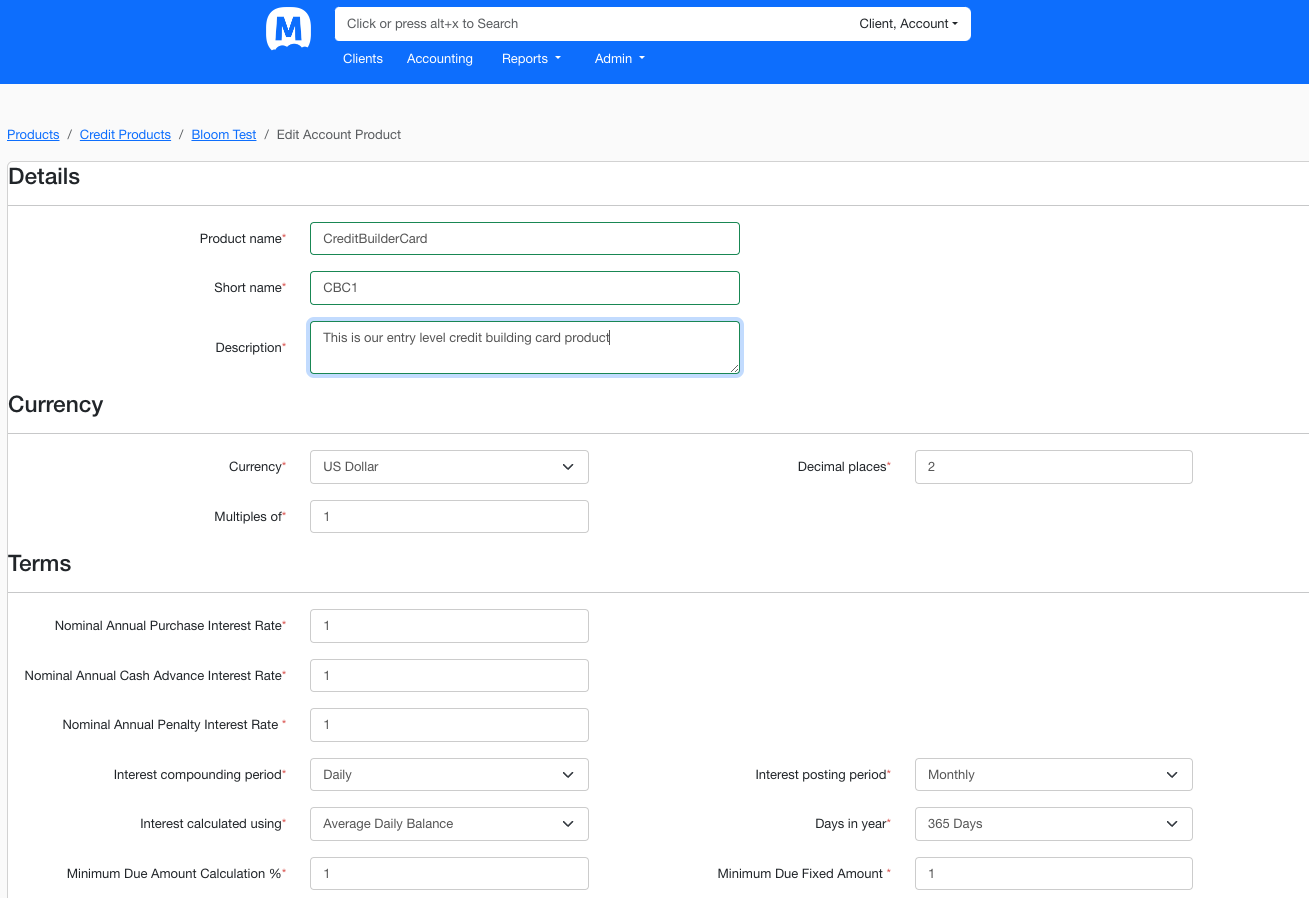

You must use the Mbanq Admin Console to create a credit card product. When you create a new credit card product, you will be required to supply a number of attributes.

Key Features:

Our platform is designed to support NeoBanks and fintech companies in their go-to-market strategies by providing essential functionality and benefits. With our credit card system, you can offer your customers a seamless and secure payment experience. The ability to make purchases confidently on e-commerce platforms and at various points-of-sale, backed by the trusted Visa brand, strengthens your brand image and builds customer trust.

-

Purchases on e-commerce platforms / point-of-sale: With the trusted Visa branded credit cards provide a safe and reliable way to make confident purchases both online and in person at various points of sale.

-

Cash withdrawals at ATMs: Credit cards offer the convenience of cash advances, allowing you to withdraw cash using a PIN number at ATMs, retail terminals, or financial institutions.

-

Billing Period: The billing period for your credit card is a straightforward timeframe, usually from the 1st to the last day of the month. This structure ensures that you always know when your statement is generated and what transactions are included in the current and upcoming billing cycle.

-

Grace days: Grace days refer to a period provided by the credit card issuer during which you can make your payment without incurring any late fees or penalties. It allows you some extra time to settle your outstanding balance after the billing cycle ends.

-

Bill Generation: With our credit card system, bills are conveniently generated through the app. You can easily access and download your statement.

-

Minimum Due: The minimum due is the smallest amount you must pay by the due date to keep your credit card account in good standing. It is typically a small percentage of your total outstanding balance, but paying only the minimum due will incur interest charges on the remaining balance.

-

Payments: Our credit card system allows you to set up automatic payments, giving you the flexibility to pay either the minimum due, the full balance, or a specified amount each month. Additionally, you have the option to make on-demand payments as needed.

-

Rewards / Cashbacks: Depending on the program type selected by your company, credit card users can earn rewards such as airline miles, cashbacks, or other incentives based on their spending. These rewards enhance the value of using the credit card for various transactions.

-

Credit Reporting: Mbanq can report the status of credit accounts to all the major U.S. Credit Bureaus in accordance with the Fair Credit Reporting Act (FCRA)

-

Military Lending Act: Mbanq automatically checks the military status of the creditor / borrower with the U.S. Department of Defense to ensure compliance with the Military Lending Act (MLA) and Servicemembers Civil Relief Act (SCRA).

Setup and Parameters

Note: All red colored asterisk mark are mandatory fields

Setup the following parameters:

| Attribute | Typical Value |

|---|---|

| Details | |

| Description | A long form description of your product |

| Short name | A short identifier ex. CV1 |

| Terms | |

| Currency | US Dollar |

| Decimal Places | 2 |

| Currency in Multiples Of | 1 |

| Nominal Annual Purchase Interest Rate | 22.49 |

| Nominal Annual Cash Advance Interest Rate | 24.99 |

| Nominal Annual Penalty Interest Rate | 1 |

| Interest Compounding Period | Daily |

| Interest Posting Period | Monthly |

| Interest Calculated Using | Average Daily Balance |

| Days in Years | 365 Days |

| Grace Periods | 25 |

| Minimum Due Amount Calculation % | 5 |

| Minimum Due Fixed Amount | 10 |

| Settings | |

| Is Secured Credit Product | false |

| Is withhold tax | Applicable |

| Is Dormancy Tracking | Active |

| Generate Statement On | 28 |

| Accounting | |

| Accounting | ACCRUAL PERIODIC |

| Fund Source | Interest Receivables |

| Credit Card portfolio | Credit Card Portfolio |

| Receivable Interest | Interest Receivables |

| Receivable Fees | Fee Receivables |

| Receivable Penalties | Interest Receivables |

| Transfers in suspense | Fee Receivables |

| Income from Interest | Interest Income |

| Income from Fees | Fee Income |

| Income from Penalties | Penal Interest Income |

| Income from Recovery Repayments | Loss Recovery Account |

| Losses Written Off | Loss Account |

| Over payments | Excess Payments |

Charges

You can configure multiple charges. For each charge you can configure the following attributes:

- Name

- Type

- Mandatory

- Amount

- Collected On

Velocities

You can also configure at the product and credit card account level spending velocity caps: (refer to: Card Product Setup)

- Single

- Daily

- Weekly

- Monthly

API References:

Updated 10 months ago