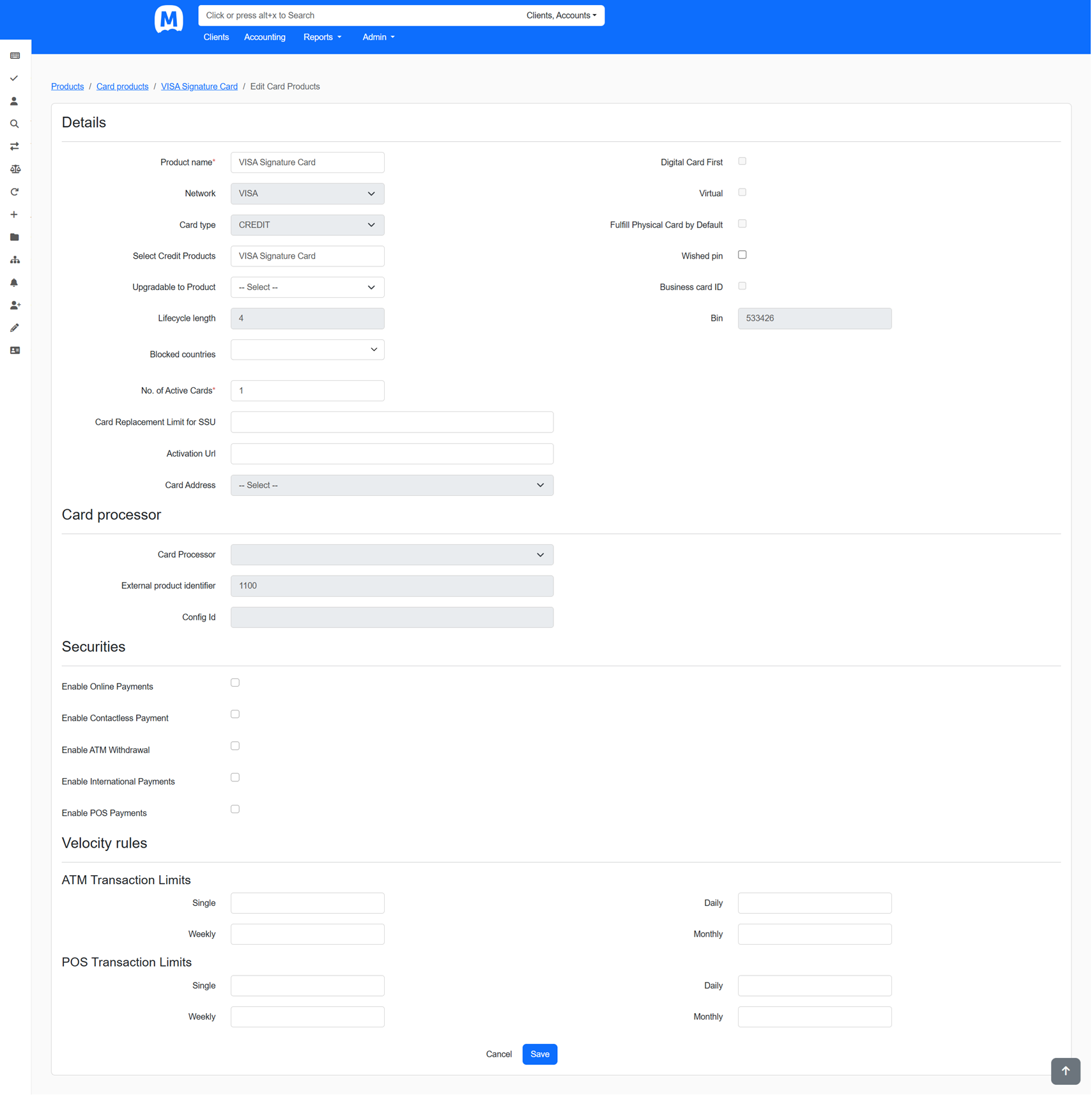

Card Product Setup

You must use the Mbanq Admin Console to create a card product. When you create a new card product, you will be required to supply a number of attributes.

Key Features:

Our platform is designed to support NeoBanks and fintech companies in their go-to-market strategies by providing essential functionality and benefits. Card products define the rules, default settings, and constraints for a financial institution's debit and credit card products. The card product setup provides a template for defining the main features and functions for the card.

Setup and Parameters

Note: All red colored asterisk mark are mandatory fields.

Main Details

| Parameter | Mandatory | Notes |

|---|---|---|

| Product name | Yes | Name of the card product (e.g., VISA Signature Card). Appears in client UI. |

| Network | Yes | Select the card network (e.g., VISA, MasterCard). |

| Card type | Yes | Defines card type (Credit, Debit, Prepaid). |

| Select Credit Products | Conditional | Required if card type is Credit. Links to credit account product. |

| Upgradeable to Product | No | Optional. Choose a higher-tier product this card can be upgraded to. |

| Lifecycle length | Yes | Validity of the card in years (e.g., 4 = 4 years). |

| Blocked countries | No | Multi-select dropdown to set up a list of countries where the card is restricted from being used. |

| No. of Active Cards | Yes | Maximum number of active cards allowed per customer. |

| Card Replacement Limit for SSU | No | Limit on card replacements per customer/branch. |

| Activation Url | No | Optional self-activation URL for the card. |

| Card Address | Yes | Address used for card delivery (e.g., registered/communication address). |

| Digital Card First | No | If checked, card is issued digitally before physical card. |

| Virtual | No | If checked, card is virtual only (no physical issuance). |

| Fulfil Physical Card by Default | No | If checked, physical card is automatically dispatched. |

| Wished pin | No | If enabled, the card will be issued without an automatically generated PIN. The PIN must then be set manually by the customer (e.g., via mobile app, internet banking, or at an ATM). |

| Business card ID | No | Used for business/corporate card mapping. |

| Bin | Yes | BIN (Bank Identification Number) for the specific card product issued by the card processor. |

Card Processor Detail

| Parameter | Mandatory | Notes |

|---|---|---|

| Card Processor | Yes | Select processor handling card transactions. |

| External product Identifier | Yes | Unique identifier for this product in the processor system. |

| Config Id | Yes | Platform/product specific configurable card design reference |

Securities

| Parameter | Mandatory | Notes |

|---|---|---|

| Enable Online Payments | No | Allows card to be used for e-commerce transactions. |

| Enable Contactless Payment | No | Enables tap-to-pay (NFC) transactions. |

| Enable ATM Withdrawal | No | Allows ATM cash withdrawal. |

| Enable International Payments | No | Enables cross-border transactions. |

| Enable POS Payments | No | Allows use at point-of-sale terminals. |

Velocity Rules

Velocity Rules are one of the key lines of defense against fraud and credit risk. They limit how much can be debited or charged to a card during various time frames.

ATM (Automated Teller Machine)

| Parameter | Mandatory | Notes |

|---|---|---|

| Single | No | Maximum amount allowed per ATM withdrawal. |

| Daily | No | Maximum daily ATM withdrawal limit. |

| Weekly | No | Maximum weekly ATM withdrawal limit. |

| Monthly | No | Maximum monthly ATM withdrawal limit. |

POS (Point of Sale also known as Merchant Terminal)

| Parameter | Mandatory | Notes |

|---|---|---|

| Single | No | Maximum amount allowed per single POS transaction. |

| Daily | No | Maximum daily POS transaction limit. |

| Weekly | No | Maximum weekly POS transaction limit. |

| Monthly | No | Maximum monthly POS transaction limit. |

Updated 6 months ago